Part of you is reality

She is everywhere. She surrounds you. You breathe her. Feel her. She is inside you. She is the reason for the change. She makes the world better.

Love.

Change yourself. Change the world.

Our jewelry brand is dedicated to creating pieces that carry profound meaning, transcending mere adornment to tell unique stories and evoke deep emotions. Each design is meticulously crafted, reflecting our commitment to infuse every piece with symbolism and significance.

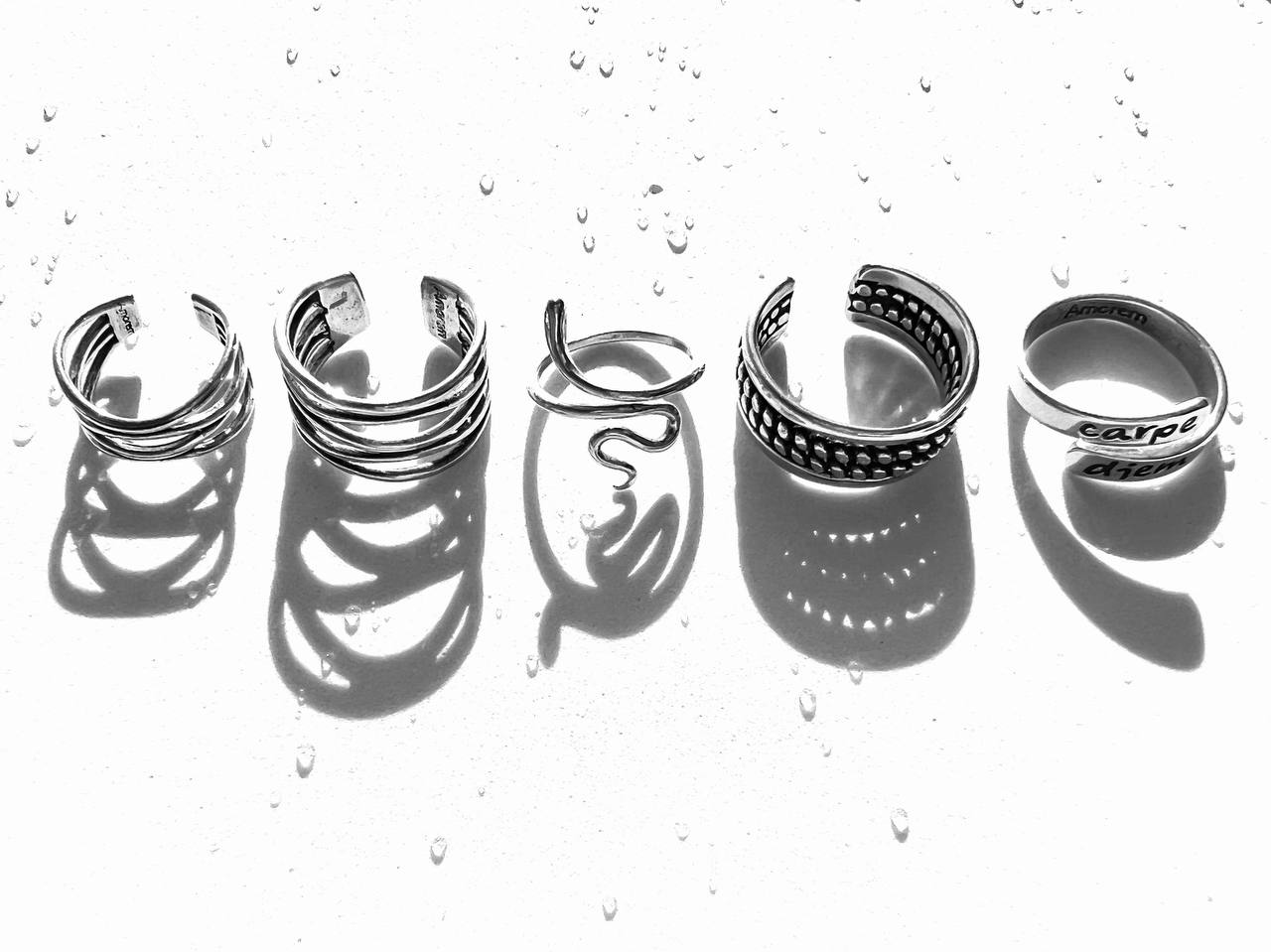

Featured collection

-

Tooth Bracelet, sterling silver

Regular price €21,00 EURRegular priceUnit price per

-

Bracelet Plane, silver 925

Regular price €24,90 EURRegular priceUnit price per

-

Motorcycle bracelet, sterling silver

Regular price €29,00 EURRegular priceUnit price per

-

Puzzle Bracelet, sterling silver

Regular price €16,00 EURRegular priceUnit price per

Featured products

-

2nd Chakra Bracelet, sterling silver

Regular price €20,00 EURRegular priceUnit price per

-

5th Chakra bracelet with Aquamarine

Regular price €16,00 EURRegular priceUnit price per

-

7 chakra bracelet, crown chakra

Regular price €16,00 EURRegular priceUnit price per

-

7 chakras bracelet, natural stones

Regular price €46,00 EURRegular priceUnit price per

Always be yourself

We put our soul into each product. The hands of the master "revive" what was recently just metal.Everyone in the Amorem team loves their profession and is passionate about the common idea.Our mission is to share love through jewelry, to help opening up your inner beauty. After all, the real beauty is not in jewelry, it is in YOU!

Gift Amorem

We believe that the most precious gift someone could give is time and warmth of his soul. This kind of gift is not about money. Our customers are happy to gift Amorem to their loved ones. Everyone who chooses Amorem jewelry as a gift, strives to present not just a thing, but love and warmth, to convey a sincere wish. Such a gift brings people together and has a special value.